Monthly Bookkeeping Services in Dubai: Why Your Business Needs Them

Monthly Bookkeeping Services in Dubai: Why Your Business Needs Them

Monthly Bookkeeping Services in Dubai Running a business in Dubai is both exciting and challenging. With a thriving economy, attractive tax benefits, and a strategic location, Dubai is a hotspot for entrepreneurs and established companies alike. But amidst all the business opportunities, one essential function often gets overlooked until it's too late—bookkeeping.

If you're a business owner in Dubai, monthly bookkeeping services can be the difference between smooth growth and financial chaos. In this blog, we’ll explore the importance, benefits, and best practices of monthly bookkeeping services in Dubai—and why outsourcing may be the smartest move for your business.

What Is Bookkeeping?

Monthly Bookkeeping Services in Dubai Bookkeeping is the process of recording and organizing all financial transactions of a business. It includes:

Tracking income and expenses

Managing invoices and receipts

Reconciling bank statements

Monitoring cash flow

Preparing financial reports

Monthly Bookkeeping Services in Dubai Unlike accounting, which involves analyzing and interpreting financial data, bookkeeping focuses on the accurate and timely recording of financial information. Monthly bookkeeping services ensure that these tasks are performed consistently and accurately on a regular basis.

Why Monthly Bookkeeping Is Crucial in Dubai

1. Compliance with UAE Regulations

Monthly Bookkeeping Services in Dubai, and the UAE as a whole, has implemented strict financial compliance rules, especially after the introduction of VAT in 2018. Businesses are required to:

Maintain proper financial records for at least 5 years

Submit accurate VAT returns quarterly or monthly

Comply with Economic Substance Regulations (ESR) and Ultimate Beneficial Ownership (UBO) laws

Monthly bookkeeping ensures you're always audit-ready and compliant with local regulations.

2. Timely Financial Insights

With monthly bookkeeping, you gain real-time insights into your company’s financial performance. This helps in:

Monitoring profitability

Managing cash flow

Identifying cost-saving opportunities

Making informed strategic decisions

In Dubai’s fast-paced market, timely decisions are everything.

3. Avoiding Financial Penalties

Failure to maintain accurate financial records can result in significant fines from the Federal Tax Authority (FTA). Monthly bookkeeping helps prevent errors and omissions that could lead to:

VAT return discrepancies

Late filing penalties

Missed expense deductions

4. Investor and Stakeholder Confidence

If you're seeking investors, loans, or strategic partnerships, clean and updated financials give you credibility. Monthly bookkeeping ensures your records are investor-ready at all times.

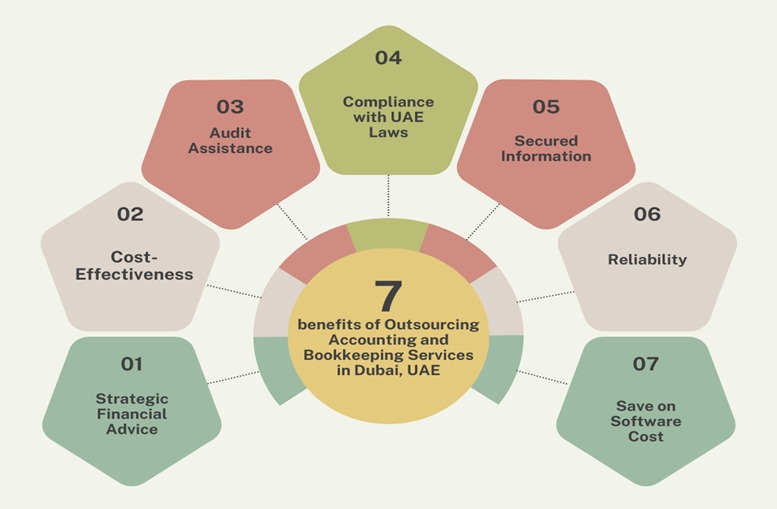

Benefits of Outsourcing Monthly Bookkeeping Services in Dubai

Monthly Bookkeeping Services in Dubai

1. Cost-Effective

Hiring a full-time, in-house bookkeeper in Dubai can be expensive. Outsourcing offers access to expert services without the overhead costs of salaries, benefits, and office space.

2. Access to Experts

Professional bookkeeping firms in Dubai are well-versed in local laws, VAT requirements, and international accounting standards. This reduces the risk of errors and ensures compliance.

3. Scalable Services

As your business grows, so do your bookkeeping needs. Outsourced services are easily scalable—whether you’re a startup or a large corporation.

4. Focus on Core Business

Letting experts handle your books frees up your time and resources so you can focus on growing your business, acquiring customers, and improving operations.

What to Expect from a Monthly Bookkeeping Service in Dubai

Monthly Bookkeeping Services in Dubai A professional monthly bookkeeping package typically includes:

Recording transactions in accounting software (e.g., QuickBooks, Xero, Zoho Books)

Bank and credit card reconciliation

Accounts payable and receivable management

Monthly financial statements (Profit & Loss, Balance Sheet, Cash Flow)

VAT accounting and filing support

Audit support (if required)

Budgeting and forecasting assistance

Some firms even provide access to dashboards and real-time reporting tools.

Choosing the Right Bookkeeping Partner in Dubai

Monthly Bookkeeping Services in Dubai When selecting a bookkeeping service provider, consider the following:

Experience with UAE regulations and VAT laws

Software expertise (especially if you're already using a platform)

Industry knowledge relevant to your business

Client reviews and reputation

Transparency in pricing

Availability for communication and support

A good bookkeeping firm should feel like a trusted partner, not just a service provider.

How Often Should Bookkeeping Be Done?

While some businesses do quarterly or annual bookkeeping, monthly bookkeeping is the gold standard. It ensures:

Regular reconciliation and error detection

Up-to-date financial records

Easy VAT filing

Faster response to cash flow issues

Monthly reviews help you spot and fix financial red flags before they become major issues.

Final Thoughts

Dubai offers a world of business opportunities, but to thrive, you need solid financial foundations. Monthly bookkeeping services help you stay compliant, make better decisions, and grow sustainably. Whether you’re a freelancer, SME, or large enterprise, investing in professional bookkeeping is one of the smartest moves you can make.

https://reliantaccount.com/

Comments

Post a Comment